Who we are?

Annapurna Finance Pvt. Ltd (AFPL) was established in 2009 and is now one of the top ten NBFC-MFIs in the country.

Annapurna Finance Pvt. Ltd (AFPL) was established to serve the economically weaker sections of society, bringing them into the mainstream by providing need-based financial services at their doorstep. The focus has been clear, to reach areas where formal financial institutions find it challenging to settle. Annapurna Finance’s objectives extend beyond outreach. It believes in providing financial and technical education, as well as strengthening entrepreneurial skills for the effective use of credit. Over the years, Annapurna Finance has continued to innovate its products and delivery mechanisms to make the entire product life cycle of micro-credit as relevant as possible for its clients. It has helped build a bridge between economic opportunity and outcome. The aim is to offer multiple need-based products that can specifically cater to all customers' life cycle needs. Established in 2009, Annapurna Finance is now one of the top ten NBFC-MFIs in the country.

September 2025

Portfolio Outstanding

0 Cr

Total Clients

0 mn

Total Branches

0

Total Employees

0

We Provide Financial Services

Microfinance is an effective tool for poverty reduction and spreading economic opportunity by giving poor people access to financial services, such as, credit and insurance.

Our Mission

Empowerment of 40,00,000 poor women and households for their economic security by 2027.

Bring recognition, legitimacy, respect and opportunity for 120,000 micro-enterprises by 2027.

Establishment of a self-sustainable and economically empowered rural, tribal & sub-urban society.

Our Vision

Our Goal

Increase availability of wider range of microfinance services.

Improve ability of 40,00,000 poor women for efficient use of such services by the year 2027.

OUR PRODUCTS

We provide financial assistance for economic empowerment.

-

JIT Loan

Just in Time Loan The Just In Time loan is a...

-

Group Loans

Income Generation Loans are smaller loans given at lower interest rates...

-

MSME Business Loan

Annapurna offers business loans to micro, small and medium enterprises to...

-

Housing Loan

Housing regarded as an asset provides a sense of social security...

-

Samarth

People with disabilities have the talent to pursue meaningful careers and...

-

Swasth

Addressing the water and sanitation needs of the rural, SWASTH provides...

Clients Speak

Don't take it from us, let our customers do the talking!

Blog Posts

Risk Management

Risk is inherent to every business and is a two-sided coin with “threat” on one side and “opportunity”...

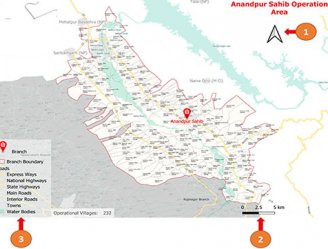

How to read a Map

We are using maps as a medium to represent various data sets spatially. It helps us to quickly...

Beyond Financial Inclusion

Annapurna Finance, because of its roots is highly invested in holistic social development. Besides, supporting a large number...

Safe Water And Sanitation To Households(SWASTH)

The idea of providing Safe Water and Sanitation to Households was conceived by the minds at Annapurna Finance...