Products & Services

Microfinance serves as an effective tool for poverty alleviation and economic empowerment by granting access to financial services like credit and insurance. Annapurna Finance plays a pivotal role in providing these services to the unserved and underserved population, enabling them to initiate or expand small businesses and elevate their incomes.

The organization extends both financial and non-financial services to resource-poor, unbanked, and marginalized individuals in rural and semi-urban areas. These services are tailored to meet the evolving needs of communities engaged in agricultural and small business activities. Annapurna Finance has also developed customized insurance products for its clients. Employing the group lending model (SHG and JLG), wherein poor women mutually guarantee each other’s loans, the organization ensures a robust support system. Borrowers undergo financial literacy training and must pass a test before accessing loans. Monthly meetings with borrowers follow a highly disciplined approach. The repayment rates on the company’s collateral-free loans exceed 99% due to diligent monitoring and follow-up on loan utilization. Additionally, Annapurna Finance has systematically introduced various individual need-based products for its clients.

In line with its commitment to serving a broader segment, the company has introduced large-size individual loans to provide financial assistance to the MSME sector. It has also launched individual loans for housing finance, catering to the affordable housing segment.

Just in Time Loan

The Just In Time loan is a pre-approved emergency loan product designed to provide quick financial assistance to existing customers. This short-term loan serves various purposes, including covering medical bills, educational expenses, debt consolidation, repairs, renovations & micro business needs among others.

Group Loans

Providing loans to rural households, especially women, to expand their existing businesses or venture into new livelihood activities, thereby diversifying their income sources. These loans could be utilized in agricultural endeavours, establishing and nurturing microbusinesses, supporting handicraft and handloom industries, among others.

| Agriculture Crops | Agri Equipment Financing | Agri Allied | Micro Enterprise | Handicraft and Handloom |

|---|---|---|---|---|

| Cultivation of different crops & land development crops like: Paddy, sugarcane, mushroom, Vegetable, groundnut etc | Bullock and Bullock cart, threshers, tractor, Power tiller, Paddy reaper, Water Pump set & lift Irrigation etc | Dairy farming, Poultry, goat rearing, Piggery, Fishery etc | Spice making, dry food processing, Individual business, Beetle shop, Fruit shop, Fast food stalls, paddy processing unit etc | Weaving cotton sarees, Bamboo products, coir production, Brass work etc |

MSME Business Loan

We extend our support to micro, small, and medium enterprises, addressing their crucial working capital requirements. Our product is strategically crafted to offer seamless financing solutions to both registered and unregistered business segments. These loans are classified into two categories, secured and unsecured, determined by the client’s profile, often influencing the loan amount. The loan supports upgrading existing business infrastructure, restocking inventory, and expanding operational capacities, among other business-enhancing endeavours.

Housing Loan

Empowering households with a sense of social security and economic well-being, we cater to the growing demand for affordable home loans. Our secured & unsecured lending solutions offer higher ticket size loans to individuals with both formal and informal sources of income, covering various needs such as home construction, flat purchase, home renovation, and balance transfers.

Samarth Loan

Financial assistance to marginalized segments who have historically been excluded from mainstream financial services. This inclusive program specifically targets individuals such as persons with disabilities, transgender people, single mothers, widows, unmarried women, and leprosy-affected communities.

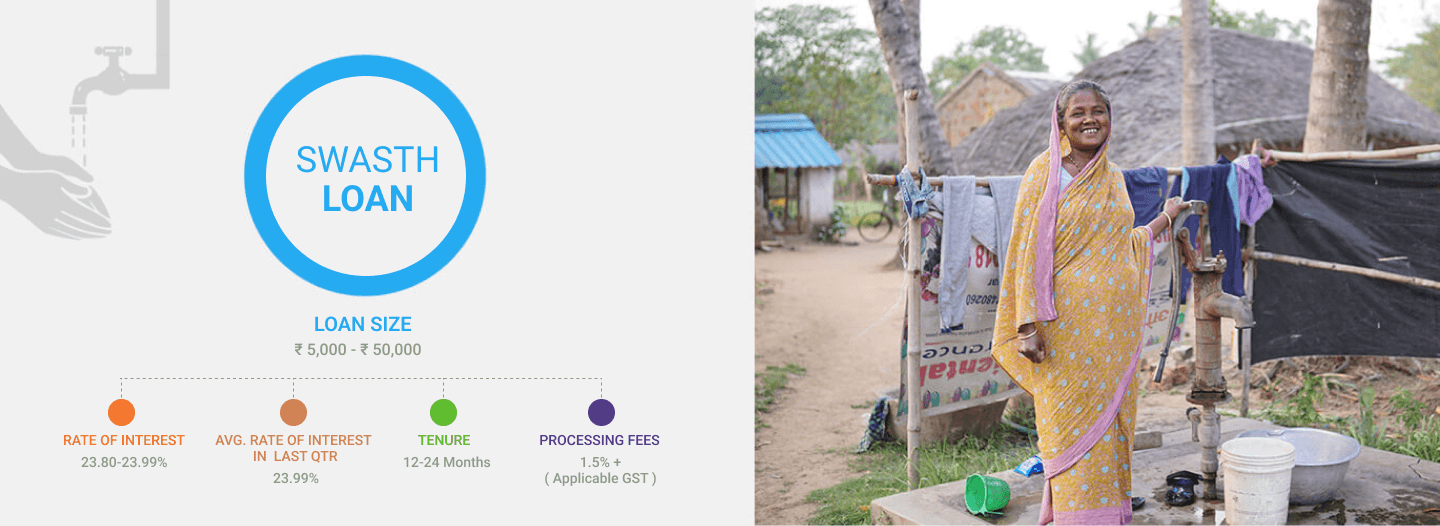

Safe Water and Sanitation to Households (SWASTH)

Our SWASTH Loan is designed to facilitate the installation of safe water and sanitation infrastructure. Our loan product is structured to deliver a wide range of advantages, including increased convenience, time savings, improved privacy, enhanced safety, decreased healthcare costs, and an overall enhancement in the quality of life.

Dairy Development Loan

Our Dairy loan aims to provide comprehensive financial assistance for various aspects of dairy farming. This includes financing for cattle purchases, infrastructure development, medical support, and other additional expenditures.

Rooftop Solar Loan

Financial assistance for the installation of solar panels, catering to both residential and commercial needs. We aim to facilitate the transition towards renewable energy sources, supporting individuals and businesses in harnessing the power of solar technology for a greener tomorrow.

Consumer Durable Loans

The loan targets our existing customers seeking financial support for the acquisition of consumer durable goods & home appliances. Its purpose is to fulfil their financial requirements and facilitate an enhanced quality of life.

Home Improvement Loan

Our Home Improvement loan empowers customers to enhance their existing homes, thereby elevating their quality of life and ensuring their privacy, safety, and well-being. By availing this loan, individuals and families can upgrade their living conditions, creating a positive impact on their lives.

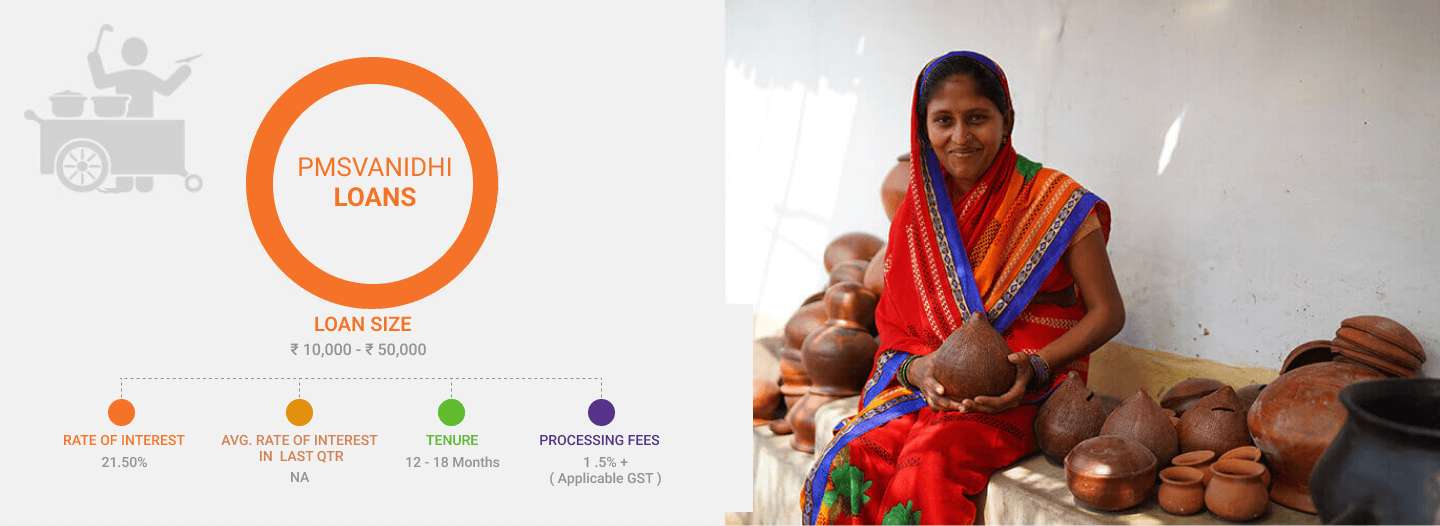

PMSVANidhi Loan

Providing essential working capital assistance to street vendors who are actively engaged in vending their goods and services in both urban and rural areas.